In what appears to be a remake of the Bollywood movie Raid — anti-evasion officers of GST Gautam Budh Nagar Commissionerate virtually stirred a hornet’s nest when acting on the basis of actionable intelligence they raided the premises of M/s Tentech LED Display Pvt. Ltd, an Indo-Chinese collaboration located at Wegmans Business Park, Greater Noida.

Interestingly, while the Company went out of the way to hide its Chinese connection, investigations revealed that there were two companies – one based in Greater Noida (https://tentechled.in/) and the other was based in Shenzhen, China (https://www.tentech-leddisplay.com/). Both the companies were operating under the trade name Tentech LED and while they operated two different websites to hide their connections with each other– the logo of both the Companies was same.

Tentech Shenzhen, China was founded in 2015 while Tentech Greater Noida was incorporated with Roc Kanpur in 2019.

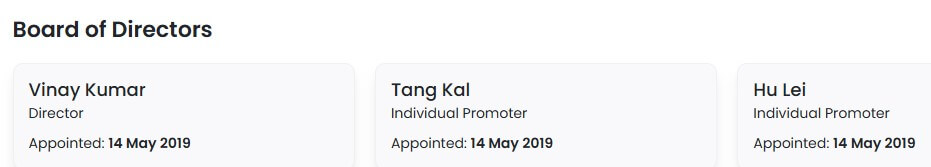

Investigations also revealed that Vinay Kumar the Managing Director and 51% Shareholder of Tentech Greater Noida as well as Alice lee alias Li Teng Li a Chinese national residing at 424D, NRI City, Greater Noida were acting as go-between on behalf of the Chinese directors and were involved in large-scale tax evasion, violations of GST laws and hawala transaction to send the money to China.

Both Vinay Kumar the company’s managing director, and Alice lee alias Li Teng Li a Chinese citizen were arrested and produced before the Chief Judicial Magistrate Special Economic Offences, Durgesh Nandini in Meerut who remanded them to judicial custody.

According to Special Public Prosecutor (GST & Customs) Lakshya Kumar Singh, Vinay Kumar and Li Tengli, were allegedly filing incorrect returns leading to a revenue loss of approximately Rs 9 crore.

Elaborating further, Sudhir Prakash Kala, the Senior GST Investigation Officer said that the company was misclassifying finished goods and mischievously declaring Visual Display Units (VDUs) as “Cabinets”. As a result, the Company was paying 18% GST instead of 28% — or 10% less GST.

Tentech LED Display is a manufacturer of LED indoor and outdoor LED screens, digital billboards, and video walls for events, advertising, and retail. Tentech was founded in 2019 in India, with a presence in China and other countries,” he added.

According to him, the Company was collecting payments as well as the applicable GST from the customers in cash but under-invoicing the sale proceeds and syphoning off the balance payment in cash to evade tax.

This apart, the company shifted its manufacturing unit from the registered place of business to Plot No.-99, Block-A, Ecotech-VI, Greater Noida without informing the GST Department. A search conducted at the new undeclared premises on 22.05.2025, led to the recovery of incriminating documents as well as seizure of raw materials and finished goods.

According to the GST officials, scrutiny of the Company records from FY 2019-20 to FY 2024-25, revealed that the company reportedly paid Rs 91.5 lakh less GST due to misclassification of its finished goods as “Cabinet” instead of “Visual Display Unit” that attracted 28% GST.

The modus-operandi was simple – the company followed a practice where customers who wished to purchase goods at cheaper rates or without GST were given the option to pay a lower invoiced value and the differential amount was collected by the accountant in cash.

This, over a period 4-5 years from FY 2020–21 to FY 2024–25, resulted in an additional tax evasion amounting to Rs 9 crores, as per the following details:

| Financial Year | Differential Amount (Rs) | Tax Liability @28% (Rs) |

| 2020-21 | 2.09 Crore | 58.66 Lakh |

| 2021-22 | 3.81 Crore | 1.06 Crore |

| 2022-23 | 8.76 Crore | 2.45 Crore |

| 2023-24 | 7.78 Crore | 2.17 Crore |

| 2024-25 | 6.42 Crore | 1.79 Crore |

| Total | 28.88 Crore | 9.00 Crore approx |

In this manner, the Company managed to save more than Rs 9 Crores in the last 4-5 years.

Intriguingly the fudging of Company records, misclassification and under-invoicing was being done at the behest of Hu Lei and Tang Kai – the directors of the Company based in China who on paper held only 49% shares but allegedly pulled the strings and made Vinay Kumar, Teng Li and others dance to their tunes.

The skeletons started rolling out one after the other from the cupboard when the GST sleuths started recording the statements of the Company management and senior officials.

But the most important revelation came when the GST officials discovered that Vinay Kumar the so-called Managing Director & 51% Shareholder was actually a puppet in the hands of the Chinese directors and their agents. He started working with Company’s Chinese Directors as a translator but over time gained their trust and started getting involved in managing critical functions of the company. Vinay Kumar himself admitted to managing the daily operations, procurement, and customer dealings on behalf of the Chinese directors who appointed him Managing Director and 51% shareholder on March 31, 2024.

Vinay Kumar admitted that he was aware of the under-invoicing and cash collection practices to evade GST but claimed that he acted under instructions from Chinese directors. According to GST officials this however, is not acceptable as an excuse because he was the face of the entire tax-evasion racket and being the 51% shareholder benefitted the most from the alleged crime.

Likewise, Teng Li was reportedly issued an appointment letter as a security staff drawing Rs15,000 per month though she denied receiving any salary or holding any official position in the company. According to her, she had come to India in 2019 on a business visa and just visited Tentech factory occasionally as a friend of Chinese Director Hu Lei.

Investigations by the GST anti-evasion officers however revealed that Teng Li was allegedly a cash handler, responsible for channelling illegal proceeds from the illegal sales by the company. She took orders directly from the Chinese directors Hu Lei and Tang Kai and routinely operated as a cash collection agent on their behalf.

This apparently is not Teng Li’s first brush with the law as she had allegedly been arrested by U.P Anti-Terrorist Squad, while trying to procure SIM cards using forged documents in a money laundering case in 2021. Teng Li also appears to have been arrested by ED for her involvement in an Rs 100 crore money laundering scam and hence is a habitual offender.

In the present case, although Teng Li denies her association with M/s Tentech LED Display Pvt. Ltd, GST officials claim to have ample evidence to prove that she was reportedly one of the kingpins of the money laundering operations and actively involved in hawala transactions to transfer the ill-gotten sale proceeds collected in cash by to the real beneficiaries operating behind the scene in China.

Li is understood to have came to India in 2019, but even though her visa expired in 2020, she continues to stay in India without valid documents.

According to the officials involved in the investigation, the Company managed to save GST tax worth more than Rs 9 Crores in the last 4-5 years but the actual amount undeclared collected by the Company should have been to the tune of Rs 30 crore or more. “This figure was not even mentioned in the books of account, which means that it was a money laundering scam worth Rs 30 Crore or more, which was syphoned-off in the last 4-5 years,” the official said.